ARTICLE

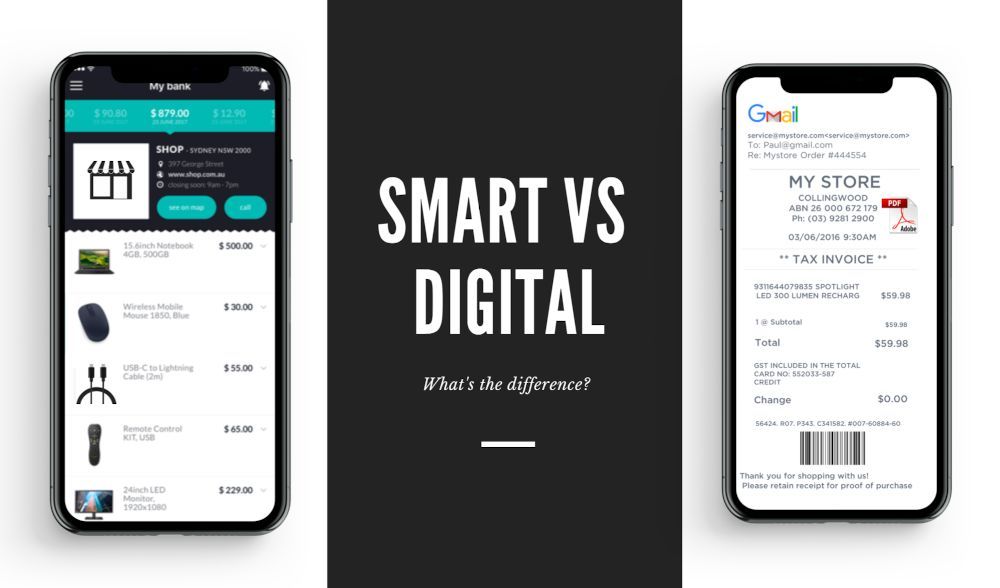

Smart Receipt VS Digital Receipt

This month Nike announced a “smart shoe” that self-laces according to the perfect fit (Wired). Last night while watching TV, Netflix probably suggested shows you’ll like based on previous ones you’ve watched; and this morning, you may have paid for your coffee using your watch. Smart house, smart car, smart phone, smart TV – all new technology we’ve come to love and depend on over the past decade. But what makes a product smart?

By definition, the word “smart” defines something as “connected.” It’s an asset embedded with software and connectivity that allows data to be exchanged between the product and its environment (Wikipedia). In other words, a smart product is something that works for you. It should make your life easier by learning your preferences and anticipating your needs.

One question we are often asked at Slyp is ‘what’s the difference in a digital receipt vs a smart receipt?’

A digital receipt, or e-receipt, is a proof of purchase issued through email or text, typically sent as a PDF. Retailers are starting to use digital receipts because of their business benefits and some customers prefer them over traditional paper receipts.

At Slyp, we define a smart receipt as a connected, interactive and intuitive receipt that is automatically sent to a customer’s mobile banking app. Smart receipts are good for the environment, they don’t fade, and they speed up the process at check out, (unlike digital receipts, which require the cashier to collect the customer’s email or phone number in order to process). They’re also less expensive than thermal receipts which cost retailers an average of $0.02 per transaction.

Unlike a PDF or static receipt, a smart receipt is a connected receipt, and therefore can provide additional benefits to a customer. Here are a few other things a smart receipt can do that a digital receipt cannot:

Automatically link to your banking app without needing to share personal details

Live web links so you can view more information about the products purchased (think user manuals)

Set return and warranty reminders in your calendar

Export to finance apps for tax and expense purposes

Allow customer to sign up to a merchant rewards scheme in “one-tap"

Learn purchase behaviour and suggest other things you may need including offers

However, while digital receipts are here, customer adoption has been slow – and so has merchant uptake. Digital receipts have three major obstacles to adoption:

The retailer’s staff need to be trained (and disciplined) to remember to ask for the customer email

Customers have to be willing to provide their person data in public

There has to be a compelling need for the digital receipt – they only act as a proof of purchase for any subsequent claims (return, tax, expense etc)

Digital receipts may solve the problem of not using paper, but it doesn’t solve the problem of convenience or privacy – this is why the smart receipt was invented.

We are thrilled to announce that Slyp has officially achieved B Corp certification. This is a significant milestone in our journey towards creating a positive impact, and we couldn’t be prouder to be ...

New initiative, FutureProof, is on a mission to tackle the environmental impact of 10.6 billion thermal paper receipts printed in Australia every year.

To celebrate World Earth Day 2023, we chatted to Scotch & Soda’s Sustainability Director, Jelle De Jong and National Brand Manager, Sascha Moore, about authentic sustainability vs greenwashing in fash...